Dear Investor,

First of all, allow me to congratulate you on making one of the wisest investments — investing in knowledge, strategic thinking, and your own trading future.

In this in-depth article, I will share a panoramic view — not through the lens of empty theory, but through hands-on experience forged over 17 continuous years of living with the market. This has been a persistent journey grounded in Price Action trading — the core foundation — strategically combined with the philosophy of Trend Following. The fusion of the simplicity of price action and the probabilistic strength of market trends has formed what I call “the art of sustainable financial survival.”

17 Years of Forex Trading Experience: A Strategic and Practical Perspective

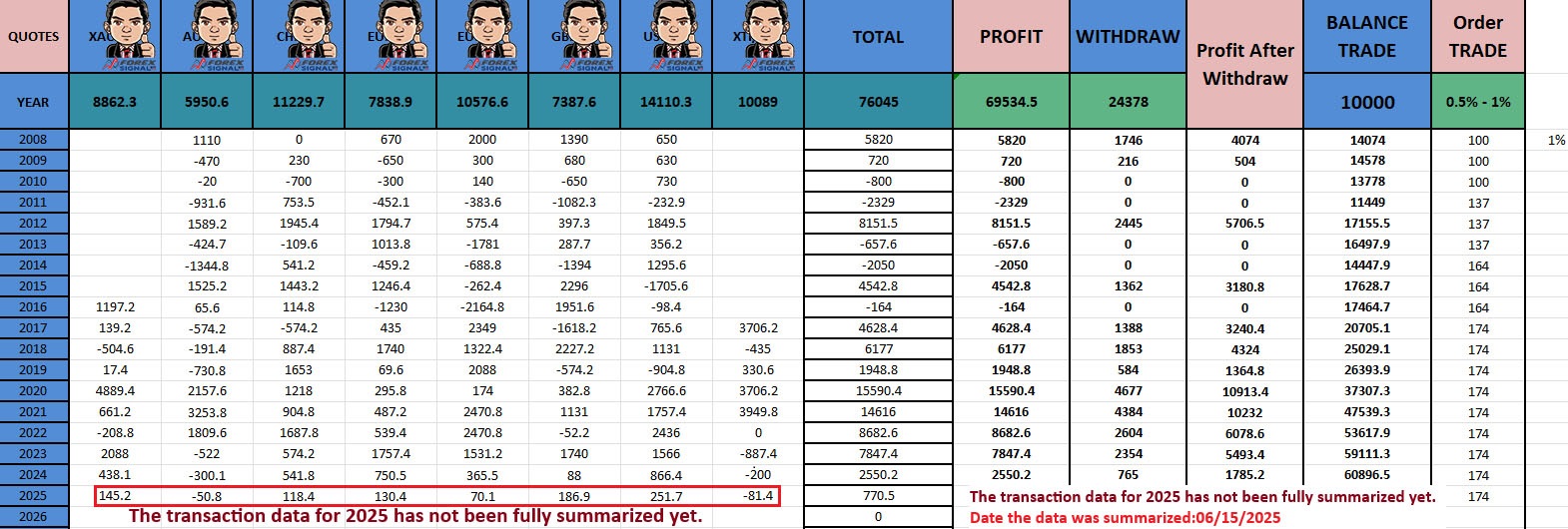

17 Years of Trading History

When evaluating net profit performance over 17 consecutive years of trading in the foreign exchange market, what stands out is not merely the growth figures, but the sustained stability over time. This achievement is a direct result of strictly adhering to disciplined risk management: never allowing any single position to risk more than 1% of the total account value. This principle, viewed through the lens of statistical probability and mathematical expectancy, serves as the cornerstone for controlling profit volatility, minimizing cumulative losses, and preserving liquidity across all market cycles.

Another essential element in the trading system I employ is the selection of timeframes for analysis. A multi-timeframe structure not only enhances the accuracy of trend identification but also increases the probability of successful trade execution. Specifically, I use the daily chart (D1) to analyze macro-level trends and the overall price action structure — a timeframe known for its high signal-to-noise ratio and strong reliability. Once the market context is clearly defined, I shift to the H4 chart to identify precise entry signals. This approach involves no mystical model or predictive magic — it is simply the systematic application of classical technical analysis principles within a probabilistic framework.

In the retail trading world, we must recognize the reality that there is no holy grail — no model or automated tool can replace strategic thinking and market experience — at least within the resources accessible to individual investors. Large institutions and professional market participants — often referred to as the “sharks” — always have a significant advantage. Therefore, the survival path for individual traders is the ability to flow with the forces of these major players. In other words: never trade against the main market trend.

Trading Is Not Luck — but the art of disciplined practice:

The journey to becoming an effective trader bears many similarities to training to be a professional athlete in sports that require strategy and high reflexes, such as tennis, football, or basketball. Learning the theory — the “rules of the game” — is the easy part. However, to consistently compete and win requires relentless practice, accumulated experience, and the honing of strategic instincts over time. Most top athletes have one thing in common: they started early and developed their skills through thousands of hours of deliberate training.

I am fortunate to be among those — I was drawn to the financial markets at 18, at a time when this field was still relatively new and underdeveloped where I lived. Over the past 17 years, I’ve experienced many market ups and downs. Now at 35, after accumulating experience and fine-tuning strategies through real trading, I’m ready to introduce two strategic trading models: 4Quotes and 8Quotes. Both are built on a pure price action foundation, tightly integrated with trend analysis to exploit high-probability recurring patterns in the market. I call this approach: “The Art of Sustainable Financial Survival” — a method focused not only on short-term profits but also on sustainability, adaptability, and strategic risk control.

These two models are designed specifically for serious traders—those who approach the market not as a game, but as a discipline requiring intellect, discipline, and a systematic approach. Both 4Quotes and 8Quotes will be offered as paid applications, accompanied by comprehensive operational guides to ensure consistency and alignment in strategy execution.

Detailed content will be updated on the official platform in the next phase: https://forexsignalpro.net. This is not just a place to share knowledge — it's a space for traders who think in systems, act with discipline, and grow over time.

DLQ Trader