Sustainable trading always begins with the right mindset.

Knowledge is necessary, but only real market experience, discipline, and the ability to control your reactions to the market create long-term results.

In this article, I share lessons learned from more than 17 years of continuous trading—not from theory or marketing, but from real experience in real markets.

Trading Experience vs. Trading Theory

Over the years, I have come to realize that successful trading is not built on complex indicators or secret systems, but on:

- Consistency

- Probabilistic thinking

- Strict risk management

Most traders fail because they:

- Seek absolute certainty

- React emotionally to price movements

- Ignore risk during decision-making

A Simple but Effective Approach

- Price reflects all available market information

- Price moves within structure, not randomness

- Risk management is more important than being right

👉 The goal is not to win every trade, but to survive long enough for profits to materialize.

17 Years of Forex Trading: What Truly Matters

Looking back on 17 years of trading, the most important factor is not explosive growth, but stability over time.

One Simple Rule I Apply Every Day:

“Never risk more than 1% of account on a order trade.”

This rule helps me to:

- Survive unfavorable market conditions

- Preserve capital during losing streaks

- Maintain long-term growth

Trading is a game of probability and mathematical expectancy, and an edge reveals itself over time—not over a handful of trades.

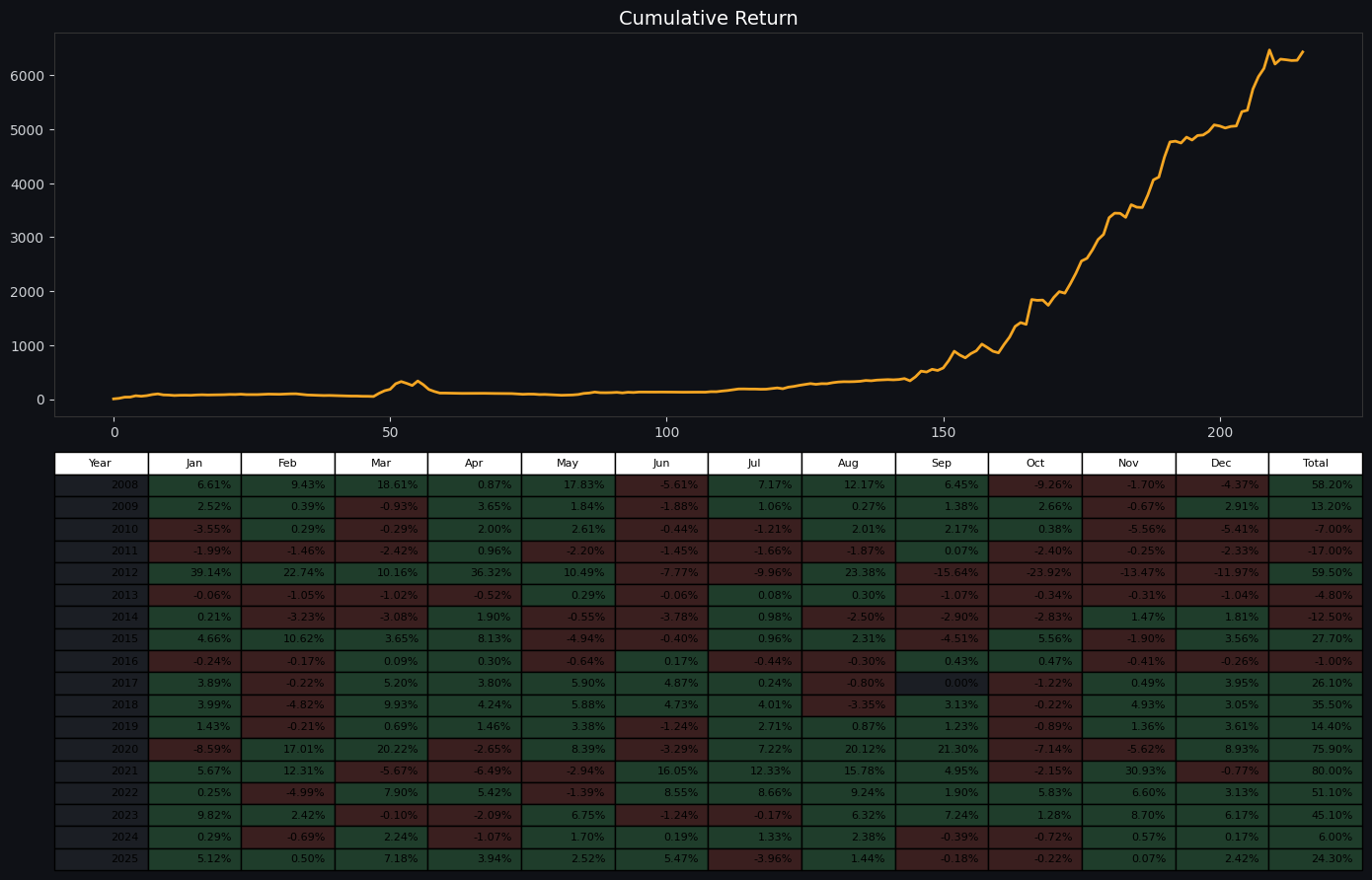

Performance Snapshot (Long-Term Perspective)

The chart below reflects long-term capital growth across multiple market cycles.

The objective is not aggressive acceleration, but controlled compounding with drawdown containment.

Multi-Timeframe Analysis: Structure Before Entry

A core component of my approach is multi-timeframe analysis:

- Daily (D1): Identify the primary trend and overall market structure

- H4 / H1: Locate key reaction zones

- Lower timeframes: Optimize trade entries

This method:

- Removes emotional decision-making

- Helps traders operate systematically

- Is based on what the market is showing, not on prediction

👉 No prediction—only planned reaction.

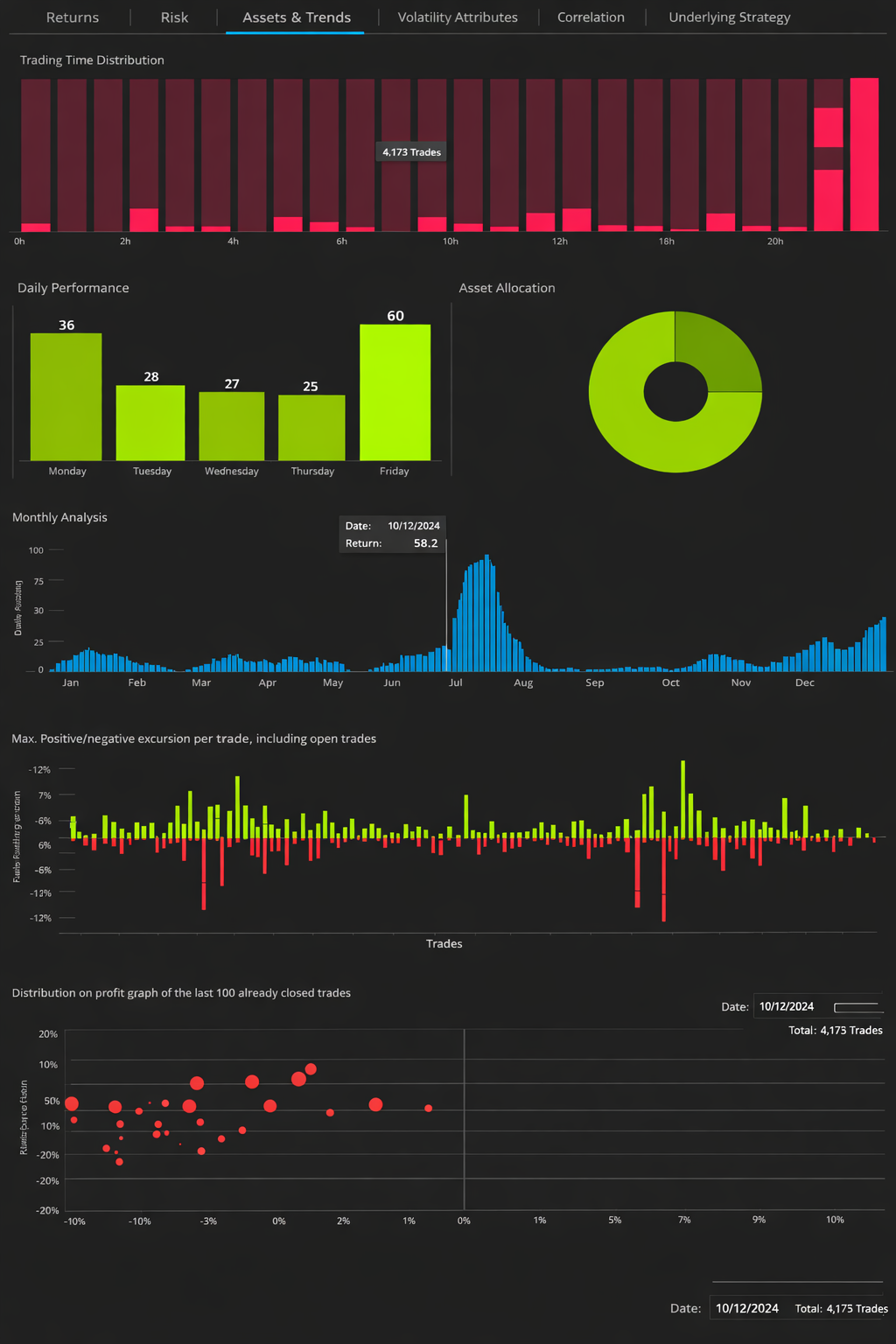

Execution Structure & Trade Behavior

These statistics reflect how trades are distributed across time, sessions, and market conditions —

reinforcing a rule-based, context-driven execution process rather than discretionary guessing.

Retail Traders vs. Institutional Players

One harsh reality is that retail traders cannot compete on equal terms with institutional players due to:

- Smaller capital

- Inferior technology

- Informational disadvantages

Therefore, retail traders must align themselves with institutional flow, rather than attempting to pick tops or bottoms or trade against dominant trends.

Trading Is Not Luck — It Is Disciplined Practice

Many people believe that trading success comes from luck.

In reality, this is only a surface-level perception.

- Short-term results may look like luck.

- Consistency is the result of discipline

- Long-term success comes from deliberate practice

👉 Luck may help you win a few trades, but only discipline allows you to survive and grow over time.

Every consistently profitable trader shares common traits:

- Clear systems

- Repeatable processes

- Emotional control

From Experience to Structured Trading Models

Over time, I transitioned from discretionary trading to structured trading models.

A Robust Trading System Must Include:

- Clear logic

- Strict risk management rules

- Repeatability

These systems are not designed for gambling, but for:

- Market survival

- Sustainable growth

- Minimizing emotional errors

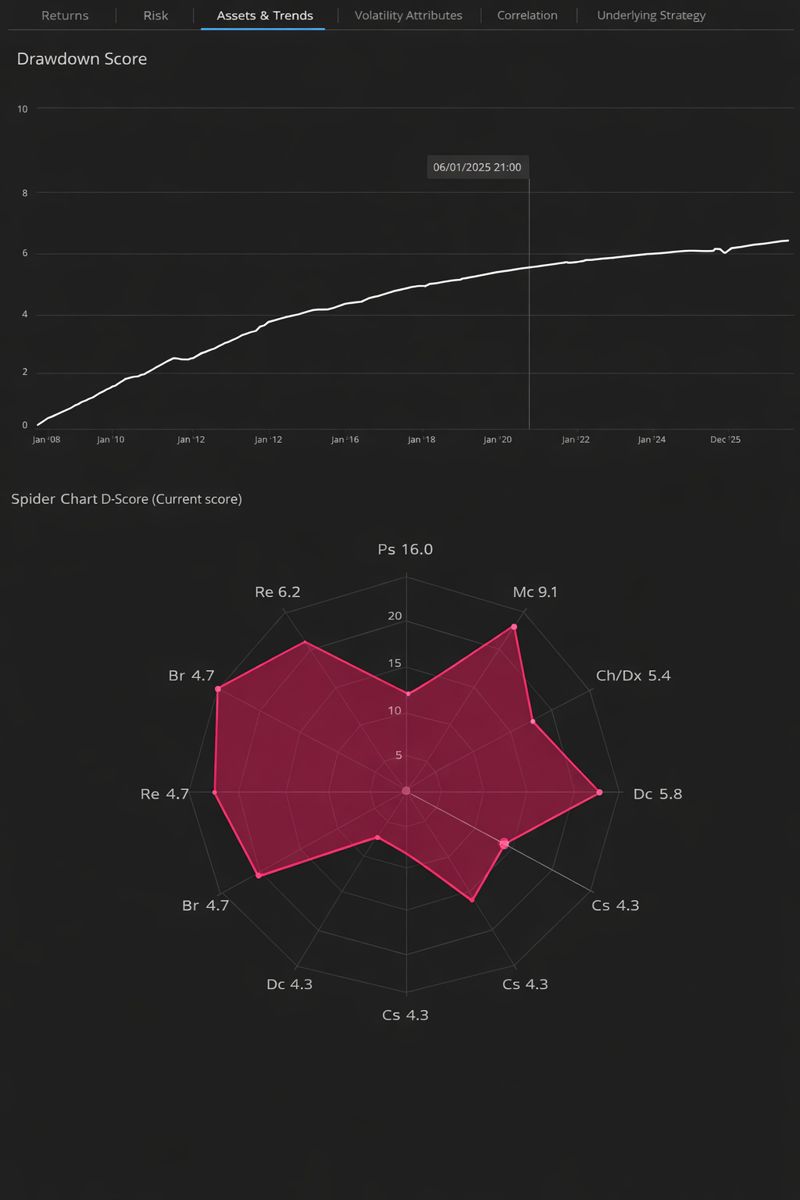

Risk Profile & Drawdown Characteristics

Long-term survival is defined not by peak returns, but by how drawdowns are controlled, recovered, and statistically distributed.

Final Thoughts

Forex trading is not a get-rich-quick path.

It is a journey that requires:

- Patience

- Discipline

- Statistical thinking

- Emotional control

“Survival comes first—profits come later. Without consistency, survival is impossible.”

This article is not a holy grail, but practical knowledge for serious traders.

Remember:

- Trade with structure

- Act with discipline

- Aim for long-term growth

DLQ Trader